Sunday, November 28, 2010

Thursday, November 25, 2010

RSA Animate - Drive: The surprising truth about what motivates us

<iframe title="YouTube video player" class="youtube-player" type="text/html" width="500" height="390" src="http://www.youtube.com/embed/u6XAPnuFjJc" frameborder="0"></iframe>

Wednesday, November 24, 2010

Report slams grad rates at 2 campuses

Report slams grad rates at 2 campuses

The report by the Education Trust, a Washington-based education reform advocacy organization, singles out the University of Phoenix, the nation's largest for-profit higher education provider, for criticism.

Just 9% of the students who began as first-year students in 2002 had graduated in 2008 across 42 branches of the university system. At two campuses -- one serving metro Detroit and another serving western Michigan -- the rates were 9% and 8%, respectively.

Nationwide, across all four-year for-profit institutions, the graduation rate was 22%. Rates at public schools are 55%, and 65% at private nonprofit schools.

Manny Rivera, spokesman for the University of Phoenix, said in a statement Tuesday that the report doesn't take into account that the University of Phoenix tends to enroll nontraditional students who "take longer to finish their degrees because they have families and professional obligations."

Labels:

education trust,

for-profit,

Michigan,

Phoenix

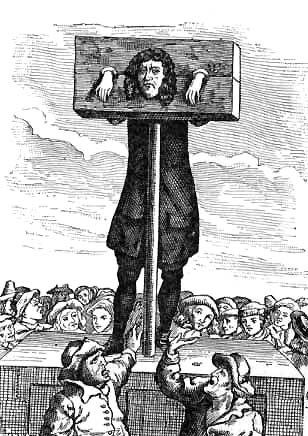

Maine Children's Services Administrators Need To Be Pubicly Flogged

I am deeply disturbed by the tone of this article.

The Maine program experiencing this magnitude of cost overruns has nothing to do with quality of services as most families struggle to access basic services for children, it has to do with basic incompetency of administration.

Maine is notorious, as well as many other states, to shift the burden of child welfare services to child welfare services. Yes this is redundant so allow me to expound upon this.

The basic revenue-maximization scheme is to place the child under the auspices of the state to access more financially beneficial funding streams.

Simply put, Maine will put a kid in foster care for reimbursement of administrative costs to provide basic services that should have been provided in the first place if there was leadership who was in possession of rudimentary elements of public administration.

Then, as kids, particularly special needs children, are snatched and placed into foster care services, national statistics become skewed showing how horrible parents are in the state. In reality, this is how Maine thought it would get away with trying to balance it budget on the billable souls of kids.

Here, reactively, the state begins to cut services provided to the community.

MaineCare Medicaid Policy Revision

Due to woefully inadequate management, the state must take away from the community to make up for its budgetary shortfalls.

So why are there shortfalls to begin with? Well, when you have child abuse propaganda machines conditioning public opinion to justify placing a child in foster care, for billing purposes of Medicaid Targeted Case Management, of course, on the idea that the state is providing educational special needs services due to child abuse and neglect, you have the fundamental elements of fraud, waste and abuse of federal and state funding.

And, if you dope these special needs kids with psychotropic meds, the state thinks that the rate of administrative payment increases.

Mainecare, its Department of Education, Department of Health and Human Services and its contactual partnerships need to be publicly flogged. If no one wants to flog them, then, contractually debar them.

See, an official of the State of Maine (a fan) informed me that the legislature, with advice and consent of the child abuse propaganda machines, was to "ease the rules" a bit when it came to accessing certain educational services. It seems parents were challenging the liberal application of psychological diagnosis (ADHD, Bipolar), so the "easing of the rules" allowed for greater access to educational services for children at a higher rate of reimbursement.

HHS Appellate Decision on Maine Department of Health and Human Services 2009 Targeted Case Management

The Maine program experiencing this magnitude of cost overruns has nothing to do with quality of services as most families struggle to access basic services for children, it has to do with basic incompetency of administration.

Maine is notorious, as well as many other states, to shift the burden of child welfare services to child welfare services. Yes this is redundant so allow me to expound upon this.

The basic revenue-maximization scheme is to place the child under the auspices of the state to access more financially beneficial funding streams.

Simply put, Maine will put a kid in foster care for reimbursement of administrative costs to provide basic services that should have been provided in the first place if there was leadership who was in possession of rudimentary elements of public administration.

Then, as kids, particularly special needs children, are snatched and placed into foster care services, national statistics become skewed showing how horrible parents are in the state. In reality, this is how Maine thought it would get away with trying to balance it budget on the billable souls of kids.

Here, reactively, the state begins to cut services provided to the community.

MaineCare Medicaid Policy Revision

Due to woefully inadequate management, the state must take away from the community to make up for its budgetary shortfalls.

So why are there shortfalls to begin with? Well, when you have child abuse propaganda machines conditioning public opinion to justify placing a child in foster care, for billing purposes of Medicaid Targeted Case Management, of course, on the idea that the state is providing educational special needs services due to child abuse and neglect, you have the fundamental elements of fraud, waste and abuse of federal and state funding.

And, if you dope these special needs kids with psychotropic meds, the state thinks that the rate of administrative payment increases.

Mainecare, its Department of Education, Department of Health and Human Services and its contactual partnerships need to be publicly flogged. If no one wants to flog them, then, contractually debar them.

See, an official of the State of Maine (a fan) informed me that the legislature, with advice and consent of the child abuse propaganda machines, was to "ease the rules" a bit when it came to accessing certain educational services. It seems parents were challenging the liberal application of psychological diagnosis (ADHD, Bipolar), so the "easing of the rules" allowed for greater access to educational services for children at a higher rate of reimbursement.

HHS Appellate Decision on Maine Department of Health and Human Services 2009 Targeted Case Management

Child services program over budget by 70 percent

AUGUSTA, Maine — The state’s Child Development Services program is over budget and will need more than $13 million to get through the current budget year. The state appropriation for the program is $14.9 million for this budget year.

“CDS has overexpended their account by close to 70 percent,” said Rep. John Martin, D-Eagle Lake. “The demand for CDS funding is for more than we appropriated.”

He said the overspending reinforces his opinion that the state should abolish the program, a move he supported 10 years ago.

James Rier, finance director for the Department of Education, said CDS has been undergoing a major reorganization required by the Legislature and standardizing services across the system has left the budget for the program short this budget year.

Rier proposed filling the hole by taking $5.7 million from a section of General Purpose Aid to Education that pays for the education of state wards and $7.4 million from an appropriation of cash from the general fund.

He said the agency is preparing a request for the supplemental budget that is expected to go to lawmakers in January that shifts some funds and asks for additional funding.

CDS provides both case management and direct services for children through age 5, with needs ranging from learning disabilities to mental health services. Some services can be covered under the state’s Medicaid program, called MaineCare, which means the federal government pays roughly two-thirds of the cost for those children that meet the eligibility standards.

The reorganization of CDS that took effect July 1, 2010, was in part a response to federal concerns that some of the services being billed to MaineCare were not allowed and there were inconsistent regulations between CDS sites across the state.

Both Education Commissioner Angela Faherty and Health and Human Services CommissionerBrenda Harvey were questioned by members of the outgoing Education Committee earlier this month.

“Whether or not they get services is determined by the eligibility criteria under the education act,” Faherty said. “If they are not medically necessary, they cannot be reimbursed by MaineCare.”

The loss of MaineCare funding is projected to cost the CDS program about $8 million in each of the 2012 and 2013 budget years and will be part of the next two-year state budget discussion.

Complicating an already complex situation is the DHHS shift to a new bill-paying system on Sept. 1, which has not gone as smoothly for school districts and CDS as it has for other MaineCare providers that bill for services through the system. Several districts told lawmakers earlier this month that they were experiencing billing problems and in some cases had yet to receive reimbursement for services billed in September.

“We heard a lot of concerns and we know they are going to have to be addressed,” said Sen. Justin Alfond, D-Portland, co-chairman of the outgoing Education Committee and assistant Senate minority leader in the new Legislature.

David Stockford, director of special services at DOE, said while there are concerns with the way the system has operated and its costs, it has been successful in preparing children for school and avoiding costs for school districts in future years.

“There are numbers of these children who, having received early intervention services, are able to enter the school-age programs with little or no service,” he said.

A study released in September found the problem of children with learning disabilities should be addressed early, but many are not being diagnosed until they start school. It indicated more money may be needed in the future to meet the need.

Only 22 percent of Maine children are being screened before starting school, according to census data. In the last school year, 812 children were first identified as needing special services when they started school. There were already 875 children receiving services through CDS.

Administration of Maine and Michigan were the inspiration for this educational video:

Administration of Maine and Michigan were the inspiration for this educational video:

Tuesday, November 23, 2010

The State University Monopoly Problem

Competition is always better than state sanctioned monopolies. However more and more there are government sponsored monopolies.

One area where monopolies run rampant is in state universities where the universities conduct "sponsored" programs. Where sponsored is simply another way of saying that the taxpayer is picking up the bill.

The hypocrisy of these universities is that any economics professor will tell you that monopolies is not good business practice as it harms the consumer, the market and competition, yet these same professors are often employed by a state sanctioned monopoly known as a "State University"

The Universities then take taxpayer money, set up what should be businesses and run these enterprises under their 501(c)(3) status without paying taxes. How many consulting businesses do you know run out of Universities. The Universities have businesses ranging from Dairy Inspections, to Vet services, to agricultural services to foster care and counseling services.

Billions of taxpayer dollars go to fund the University-based businesses each year with all the residual money going towards the University or into State coffers as part of their intergovernment money laundering transfer system.

This is from a blog focusing on Arizona State University.

Why is ASU the only public, 4-year university in a metro area of 4 million? Other cities smaller than Phoenix have more than one public university; I will assert that if Phoenix and Arizona intend to stay competitive with the rest of the country then the system in Arizona must restructure to provide greater accountability and accessibility to residents. Overcrowding at ASU can be reduced, quality can be increased and costs can be lowered when there is access to more public higher education. (I’m not discounting community colleges. Phoenix has many community colleges but they all feed into one and only one state university in the Valley of the Sun.)

To address this problem the Arizona Board of Regents (ABOR) must discard the idea of “one university in many places.” Disjointed, under-utilized satellite campuses governed by one central authority can not provide a quality education at an affordable price. Even more unfair to students is that a university in “many places” forces students at the satellite campuses to subsidize expensive research programs and parking structures at the “main” campus. But why should they?

For very little money Phoenix can have two new public universities. ASU West could become its own non-research university, with its own budget, own admission standards, and its own tuition rate. It could offer its own programs in business, education, etc and because it would be a non-research university, the cost to attend would be much cheaper. It could be called Phoenix State University or Central Arizona University, highlighting the metro area where it is located. (Think Chicago State University, or San Diego State University.)

The Polytech campus in the east valley could be integrated to become a medium-cost, moderate research university offering degree programs in Math, Humanities, Engineering and Technology. We could call it Arizona Tech University, or Arizona Institute of Technology.

60-65% of the statewide population lives in Greater Phoenix, this means 3 out of 5 Arizonans live in the metro area but we only have 1 public university. If 3 out of 5 people live here, it makes sense to have 3 distinct, autonomous public universities located here (ASU and the hypothetical Phoenix State University and Arizona Tech).

ASU is too big and wields too much power in politics and development. The Empire must be broken to give Arizonans more choices and greater access. Arizona could increase college graduation rates (rather than mere enrollment rates) and Arizona could easily strengthen its university system.

source http://psuandaztech.blogspot.com

One area where monopolies run rampant is in state universities where the universities conduct "sponsored" programs. Where sponsored is simply another way of saying that the taxpayer is picking up the bill.

The hypocrisy of these universities is that any economics professor will tell you that monopolies is not good business practice as it harms the consumer, the market and competition, yet these same professors are often employed by a state sanctioned monopoly known as a "State University"

The Universities then take taxpayer money, set up what should be businesses and run these enterprises under their 501(c)(3) status without paying taxes. How many consulting businesses do you know run out of Universities. The Universities have businesses ranging from Dairy Inspections, to Vet services, to agricultural services to foster care and counseling services.

Billions of taxpayer dollars go to fund the University-based businesses each year with all the residual money going towards the University or into State coffers as part of their intergovernment money laundering transfer system.

This is from a blog focusing on Arizona State University.

Why is ASU the only public, 4-year university in a metro area of 4 million? Other cities smaller than Phoenix have more than one public university; I will assert that if Phoenix and Arizona intend to stay competitive with the rest of the country then the system in Arizona must restructure to provide greater accountability and accessibility to residents. Overcrowding at ASU can be reduced, quality can be increased and costs can be lowered when there is access to more public higher education. (I’m not discounting community colleges. Phoenix has many community colleges but they all feed into one and only one state university in the Valley of the Sun.)

To address this problem the Arizona Board of Regents (ABOR) must discard the idea of “one university in many places.” Disjointed, under-utilized satellite campuses governed by one central authority can not provide a quality education at an affordable price. Even more unfair to students is that a university in “many places” forces students at the satellite campuses to subsidize expensive research programs and parking structures at the “main” campus. But why should they?

For very little money Phoenix can have two new public universities. ASU West could become its own non-research university, with its own budget, own admission standards, and its own tuition rate. It could offer its own programs in business, education, etc and because it would be a non-research university, the cost to attend would be much cheaper. It could be called Phoenix State University or Central Arizona University, highlighting the metro area where it is located. (Think Chicago State University, or San Diego State University.)

The Polytech campus in the east valley could be integrated to become a medium-cost, moderate research university offering degree programs in Math, Humanities, Engineering and Technology. We could call it Arizona Tech University, or Arizona Institute of Technology.

60-65% of the statewide population lives in Greater Phoenix, this means 3 out of 5 Arizonans live in the metro area but we only have 1 public university. If 3 out of 5 people live here, it makes sense to have 3 distinct, autonomous public universities located here (ASU and the hypothetical Phoenix State University and Arizona Tech).

ASU is too big and wields too much power in politics and development. The Empire must be broken to give Arizonans more choices and greater access. Arizona could increase college graduation rates (rather than mere enrollment rates) and Arizona could easily strengthen its university system.

source http://psuandaztech.blogspot.com

Sunday, November 21, 2010

Four Student Aid Lenders Settle False Claims Act Suit for Total of $57.75 Million

Four Student Aid Lenders Settle False Claims Act Suit for Total of $57.75 Million

WASHINGTON – Four student aid lenders have paid the United States a total of $57.75 million to resolve allegations that they improperly inflated their entitlement to certain interest rate subsidies from the U.S. Department of Education in violation of the False Claims Act, the Justice Department announced today.

The settlements resolve allegations brought in a whistleblower action filed in the Eastern District of Virginia under the False Claims Act, which permits private citizens to bring lawsuits alleging violations of the Act on behalf of the United States and to share in any recovery. The whistleblower suit was filed by Dr. Jonathan Oberg, a former employee of the Department of Education, who alleged that several lenders participating in the federal student financial aid programs created billing systems that allowed them to receive improperly inflated interest rate subsidies from the Department of Education. The United States did not intervene in this action, which was litigated by the whistleblower, but it provided assistance at many stages of the case, including during the settlement process.

Nelnet Inc. and Nelnet Educational Loan Funding Inc. have paid $47 million to the United States. Southwest Student Services Corp. has paid $5 million. Brazos Higher Education Authority and Brazos Higher Education Service Corp. have paid $4 million. Panhandle Plains Higher Education Authority and Panhandle Plains Management and Servicing Corp. have paid $1.75 million. Dr. Oberg will receive a total of $16.65 million from these settlements.

“Collaboration between the federal government and citizens with knowledge of fraud is important to the successful enforcement of the False Claims Act,” said Tony West, Assistant Attorney General for the Civil Division of the Department of Justice. “Whistleblowers like Dr. Oberg are critical to our efforts to recover taxpayer money lost to waste, fraud, and abuse.”

“The U.S. Attorney’s Office remains committed to assisting ordinary citizens who blow the whistle on wrongdoing by companies that take taxpayer dollars,” said Neil MacBride, U.S. Attorney for the Eastern District of Virginia. “Through the efforts of one citizen and the government, these lenders will be paying millions back to the government.”

This case was handled on behalf of the United States by the Civil Division of the Department of Justice and the U.S. Attorney’s Office for the Eastern District of Virginia, with the assistance of the Department of Education Office of General Counse

Baby LK Report: November 21, 2010

Baby LK recaps the week in news for the child protection industry.

<iframe title="YouTube video player" class="youtube-player" type="text/html" width="480" height="390" src="http://www.youtube.com/embed/xuyMwtgM4tY" frameborder="0"></iframe>

Monday, November 15, 2010

Baby LK Report: November 14, 2010

Pay attention to the published studies to see the horrifically biased findings.

Baby LK recaps the week in news for the child protective industry.

Baby LK recaps the week in news for the child protective industry.

Saturday, November 13, 2010

Policy Pimps and Welfare Queens

Here we have an elaborate scheme where University of Louisville is caught up in the middle laundrying Medicaid money in order for the state to maximize its revenues by claiming more Medicaid funds.

The levels of fraud, waste and abuse in social welfare programs do not really take place with its recipients and if so, it is minimal. Here is an example.

Many years ago, President Reagan made use of a term that has become synonymous with individuals on public assistance. That term is the "Welfare Queen".

The Welfare Queen was promoted as the representative icon of all welfare persons. She was the one who would wear mink coat, driving a Cadillac, while buying groceries with food stamps with 8 kids at home.

The nation has since adopted this distorted perception of welfare recipients as having children for money and being lazy.

It was the Heritage Foundation that created the image of the Welfare Queen. The story was based upon the fraudulent activities of one woman who fraudulently claimed around $80,000.00 in welfare.

I consider the Welfare Queen to be one of the greatest propaganda tactics of all times. Here you have an immediate, instant, on the spot available heuristic there to whip out every time there are stories such as the ones in the video, below.

A welfare queen is a pejorative phrase used in the United States to describe people who are accused of collecting excessive welfare payments through fraud or manipulation. Sensational reporting on welfare fraud began during the early-1960s, appearing in general interest magazines such as Readers Digest. The term entered the American lexiconduring Ronald Reagan's 1976 presidential campaign when he described a "welfare queen" from Chicago's South Side.[1]Since then, it has become a stigmatizing label placed on recidivist poor mothers, with studies showing that it often carries gendered and racial connotations.

A policy pimp is a phrase of parody used in the United States to describe a corporation or state, federally prosecuted of "illegally and wrongfully" filing false claims for reimbursement of welfare payments through Social Security programs of Medicare, Medicaid or TRICARE. Censored reporting on corporate welfare fraud began during the early 1960's, manifesting in the promotion of a national healthcare system, what is known today as medical insurance. Pharmaceutical corporations funded the design of university curriculum of social work and psychiatry, federal and state healthcare policies, and lobbyied as special interest groups to promote social programs which generated more customers who were mandated to take psychotic medications, allowed for clinical testing on foster children, all reimbursed through federal medical welfare programs. Since then, the appellation of policy pimps has become a national sensation, exposing the harmful nature of drugs such as Seroquel, Celexa, Geodon, Lexapro and Zyprexa.

Now, every time there is a major story of a pharmaceutical company or state being prosecuted for billions in welfare fraud, the story gets swept under the rug and reworked to blame the Welfare Queen by their corporately billionaire-funded minions, the Tea Party and their bought and paid for propaganda merchants. Tea Party campaigns are funded to stop socialism, their new name for welfare. Tea Party campaigns are also funded to distract the public from the true Welfare Kings.

Meet some Policy Pimps

The levels of fraud, waste and abuse in social welfare programs do not really take place with its recipients and if so, it is minimal. Here is an example.

Many years ago, President Reagan made use of a term that has become synonymous with individuals on public assistance. That term is the "Welfare Queen".

The Welfare Queen was promoted as the representative icon of all welfare persons. She was the one who would wear mink coat, driving a Cadillac, while buying groceries with food stamps with 8 kids at home.

The nation has since adopted this distorted perception of welfare recipients as having children for money and being lazy.

It was the Heritage Foundation that created the image of the Welfare Queen. The story was based upon the fraudulent activities of one woman who fraudulently claimed around $80,000.00 in welfare.

I consider the Welfare Queen to be one of the greatest propaganda tactics of all times. Here you have an immediate, instant, on the spot available heuristic there to whip out every time there are stories such as the ones in the video, below.

A welfare queen is a pejorative phrase used in the United States to describe people who are accused of collecting excessive welfare payments through fraud or manipulation. Sensational reporting on welfare fraud began during the early-1960s, appearing in general interest magazines such as Readers Digest. The term entered the American lexiconduring Ronald Reagan's 1976 presidential campaign when he described a "welfare queen" from Chicago's South Side.[1]Since then, it has become a stigmatizing label placed on recidivist poor mothers, with studies showing that it often carries gendered and racial connotations.

|

| David Brennan, AstraZenneca Policy Pimp |

A policy pimp is a phrase of parody used in the United States to describe a corporation or state, federally prosecuted of "illegally and wrongfully" filing false claims for reimbursement of welfare payments through Social Security programs of Medicare, Medicaid or TRICARE. Censored reporting on corporate welfare fraud began during the early 1960's, manifesting in the promotion of a national healthcare system, what is known today as medical insurance. Pharmaceutical corporations funded the design of university curriculum of social work and psychiatry, federal and state healthcare policies, and lobbyied as special interest groups to promote social programs which generated more customers who were mandated to take psychotic medications, allowed for clinical testing on foster children, all reimbursed through federal medical welfare programs. Since then, the appellation of policy pimps has become a national sensation, exposing the harmful nature of drugs such as Seroquel, Celexa, Geodon, Lexapro and Zyprexa.

Now, every time there is a major story of a pharmaceutical company or state being prosecuted for billions in welfare fraud, the story gets swept under the rug and reworked to blame the Welfare Queen by their corporately billionaire-funded minions, the Tea Party and their bought and paid for propaganda merchants. Tea Party campaigns are funded to stop socialism, their new name for welfare. Tea Party campaigns are also funded to distract the public from the true Welfare Kings.

Meet some Policy Pimps

Coming in 2011: the end of Eli Lilly as we know it

On Jan. 30, 2009, Eli Lilly and Company pleaded guilty to a violation of the Federal Food, Drug, and Cosmetic Act (FDCA). Accepting Lilly's guilty plea, the Court sentenced the company to pay a criminal fine of $515 million and asset forfeiture of $100 million, the largest criminal fine imposed against an individual defendant in the history of the United States.

The Government believed this historic criminal fine reflected the seriousness of the offense and the defendant's earlier violations of the FDCA. The Government believed the criminal fine would promote respect for the law, and that the sentence would deter Eli Lilly from further unlawful promotion of its pharmaceutical products. The Government believed a criminal fine of this magnitude would serve as general deterrence to others who might be tempted to go down the road of off-label marketing.

Under the Corporate Integrity Agreement (CIA) between Lilly and the U S. Department of Health and Human Services, the parties agreed that Eli Lilly would not be placed on probation. However, the agreement imposed a strict compliance program to ensure that Lilly's criminal conduct would not recur.

Eli Lilly is subject to exclusion from Federal Health Care programs, including but not limited to Medicaid, for a material breach of the CIA. A material breach includes failure by Lilly to report a reportable event and take corrective action. A reportable event means anything that involves a matter that a reasonable person would consider a probable violation of criminal, civil, or administrative laws applicable to any Federal Health Care program and/or applicable to any FDA requirements relating to the promotion of Lilly products.

Exclusion has national effect and applies to all other Federal procurement and nonprocurement programs.

That's the gist of it. Details to follow.

The Government believed this historic criminal fine reflected the seriousness of the offense and the defendant's earlier violations of the FDCA. The Government believed the criminal fine would promote respect for the law, and that the sentence would deter Eli Lilly from further unlawful promotion of its pharmaceutical products. The Government believed a criminal fine of this magnitude would serve as general deterrence to others who might be tempted to go down the road of off-label marketing.

Under the Corporate Integrity Agreement (CIA) between Lilly and the U S. Department of Health and Human Services, the parties agreed that Eli Lilly would not be placed on probation. However, the agreement imposed a strict compliance program to ensure that Lilly's criminal conduct would not recur.

Eli Lilly is subject to exclusion from Federal Health Care programs, including but not limited to Medicaid, for a material breach of the CIA. A material breach includes failure by Lilly to report a reportable event and take corrective action. A reportable event means anything that involves a matter that a reasonable person would consider a probable violation of criminal, civil, or administrative laws applicable to any Federal Health Care program and/or applicable to any FDA requirements relating to the promotion of Lilly products.

Exclusion has national effect and applies to all other Federal procurement and nonprocurement programs.

That's the gist of it. Details to follow.

Thank you, Dr. M. I. Bonkers for keeping us posted! We sit with baited breath on pins and needles.

If you have financial interests or own stocks in Eli Lilly, dump them now.

Here is a bit of background to the on-going saga:

Eli Lilly and Company Agrees to Pay $1.415 Billion to Resolve Allegations of Off-label Promotion of Zyprexa

$515 Million Criminal Fine Is Largest Individual Corporate Criminal Fine in History; Civil Settlement up to $800 Million

Corporate Integrity Agreement between OIG HHS and Eli Lilly

American pharmaceutical giant Eli Lilly and Company today agreed to plead guilty and pay $1.415 billion for promoting its drug Zyprexa for uses not approved by the Food and Drug Administration (FDA), the Department of Justice announced today. This resolution includes a criminal fine of $515 million, the largest ever in a health care case, and the largest criminal fine for an individual corporation ever imposed in a United States criminal prosecution of any kind. Eli Lilly will also pay up to $800 million in a civil settlement with the federal government and the states.

Eli Lilly agreed to enter a global resolution with the United States to resolve criminal and civil allegations that it promoted its antipsychotic drug Zyprexa for uses not approved by the FDA, the Department said. Such unapproved uses are also known as "off-label" uses because they are not included in the drug’s FDA approved product label.

Assistant Attorney General for the Civil Division Gregory G. Katsas and acting U.S. Attorney for the Eastern District of Pennsylvania Laurie Magid today announced the filing of a criminal information against Eli Lilly for promoting Zyprexa for uses not approved by the FDA. Eli Lilly, headquartered in Indianapolis, is charged in the information with promoting Zyprexa for such off-label or unapproved uses as treatment for dementia, including Alzheimer’s dementia, in elderly people.

The company has signed a plea agreement admitting its guilt to a misdemeanor criminal charge. Eli Lilly also signed a civil settlement to resolve civil claims that by marketing Zyprexa for unapproved uses, it caused false claims for payment to be submitted to federal insurance programs such as Medicaid, TRICARE and the Federal Employee Health Benefits Program, none of which provided coverage for such off-label uses.

The plea agreement provides that Eli Lilly will pay a criminal fine of $515 million and forfeit assets of $100 million. The civil settlement agreement provides that Eli Lilly will pay up to an additional $800 million to the federal government and the states to resolve civil allegations originally brought in four separate lawsuits under the qui tam provisions of the federal False Claims Act. The federal share of the civil settlement amount is $438 million. Under the terms of the civil settlement, Eli Lilly will pay up to $361 million to those states that opt to participate in the agreement.

Under the Food, Drug, and Cosmetic Act (FDCA), a company must specify the intended uses of a product in its new drug application to the FDA. Before approving a drug, the FDA must determine that the drug is safe and effective for the use proposed by the company. Once approved, the drug may not be marketed or promoted for off-label uses.

The FDA originally approved Zyprexa, also known by the chemical name olanzapine, in Sept. 1996 for the treatment of manifestations of psychotic disorders. In March 2000, FDA approved Zyprexa for the short-term treatment of acute manic episodes associated with Bipolar I Disorder. In Nov. 2000, FDA approved Zyprexa for the short term treatment of schizophrenia in place of the management of the manifestations of psychotic disorders. Also in Nov. 2000, FDA approved Zyprexa for maintaining treatment response in schizophrenic patients who had been stable for approximately eight weeks and were then followed for a period of up to eight months. Zyprexa has never been approved for the treatment of dementia or Alzheimer’s dementia.

The criminal information, filed in the Eastern District of Pennsylvania, alleges that from Sept. 1999 through at least Nov. 2003, Eli Lilly promoted Zyprexa for the treatment of agitation, aggression, hostility, dementia, Alzheimer’s dementia, depression and generalized sleep disorder. The information alleges that Eli Lilly’s management created marketing materials promoting Zyprexa for off-label uses, trained its sales force to disregard the law and directed its sales personnel to promote Zyprexa for off-label uses.

The information alleges that beginning in 1999, Eli Lilly expended significant resources to promote Zyprexa in nursing homes and assisted-living facilities, primarily through its long-term care sales force. Eli Lilly sought to convince doctors to prescribe Zyprexa to treat patients with disorders such as dementia, Alzheimer’s dementia, depression, anxiety, and sleep problems, and behavioral symptoms such as agitation, aggression, and hostility.

The information further alleges that the FDA never approved Zyprexa for the treatment of dementia, Alzheimer's dementia, psychosis associated with Alzheimer's disease, or the cognitive deficits associated with dementia.

The information also alleges that building on its unlawful promotion and success in the long-term care market, Eli Lilly executives decided to market Zyprexa to primary-care physicians. In Oct. 2000, Eli Lilly began this off-label marketing campaign targeting primary care physicians, even though the company knew that there was virtually no approved use for Zyprexa in the primary-care market. Eli Lilly trained its primary-care physician sales representatives to promote Zyprexa by focusing on symptoms, rather than Zyprexa’s FDA approved indications.

The qui tam lawsuits alleged that between Sept. 1999 and the end of 2005, Eli Lilly promoted Zyprexa for use in patients of all ages and for the treatment of anxiety, irritability, depression, nausea, Alzheimer’s and other mood disorders. The qui tam lawsuits also alleged that the company funded continuing medical education programs, through millions of dollars in grants, to promote off-label uses of its drugs, in violation of the FDA’s requirements.

"Off-label promotion of pharmaceutical drugs is a serious crime because it undermines the FDA’s role in protecting the American public by determining that a drug is safe and effective for a particular use before it is marketed," said Gregory G. Katsas, Assistant Attorney General for the Civil Division. "This settlement demonstrates the Department’s ongoing diligence in prosecuting cases involving violations of the Food, Drug, and Cosmetic Act, and recovering taxpayer dollars used to pay for drugs sold as a result of off-label marketing campaigns."

"When pharmaceutical companies ignore the government’s process for protecting the public, they undermine the integrity of the doctor-patient relationship and place innocent people in harm’s way," said acting U.S. Attorney for the Eastern District of Pennsylvania, Laurie Magid. "Off-label marketing created unnecessary risks for patients. People have an absolute right to their doctor’s medical expertise, and to know that their health care provider’s judgment has not be clouded by misinformation from a company trying to build its bottom line."

The global resolution includes the following agreements:

- A plea agreement signed by Eli Lilly admitting guilt to the criminal charge of misbranding. Specifically, Eli Lilly admits that between Sept. 1999 and March 31, 2001, the company promoted Zyprexa in elderly populations as treatment for dementia, including Alzheimer’s dementia. Eli Lilly has agreed to pay a $515 million criminal fine and to forfeit an additional $100 million in assets.

- A civil settlement between Eli Lilly, the United States and various States, in which Eli Lilly will pay up to $800 million to the federal government and the states to resolve False Claims Act claims and related state claims by Medicaid and other federal programs and agencies including TRICARE, the Federal Employees Health Benefits Program, Department of Veterans Affairs, Bureau of Prisons and the Public Health Service Entities. The federal government will receive $438,171,544 from the civil settlement. The state Medicaid programs and the District of Columbia will share up to $361,828,456 of the civil settlement, depending on the number of states that participate in the settlement.

- The qui tam relators will receive $78,870,877 from the federal share of the settlement amount.

- A Corporate Integrity Agreement (CIA) between Eli Lilly and the Office of Inspector General of the Department of Health and Human Services. The five-year CIA requires, among other things, that a Board of Directors committee annually review the company’s compliance program and certify its effectiveness; that certain managers annually certify that their departments or functional areas are compliant; that Eli Lilly send doctors a letter notifying them about the global settlement; and that the company post on its website information about payments to doctors, such as honoraria, travel or lodging. Eli Lilly is subject to exclusion from Federal health care programs, including Medicare and Medicaid, for a material breach of the CIA and subject to monetary penalties for less significant breaches.

"OIG’s Corporate Integrity Agreement will increase the transparency of Eli Lilly’s interactions with physicians and strengthen Eli Lilly’s accountability for its compliance with the law," said Department of Health and Human Services Inspector General Daniel R. Levinson. "This historic resolution demonstrates the Government’s commitment to improve the integrity of drug promotion activities."

In addition to the $1.415 billion criminal and civil settlement announced today, Eli Lilly previously agreed to pay $62 million to settle consumer protection lawsuits brought by 33 states. The state consumer protection settlements were announced on Oct. 7, 2008.

"Today's announcement of the filing of a criminal charge and the unprecedented terms of this settlement demonstrates the government's increasing efforts aimed at pharmaceutical companies that choose to put profits ahead of the public's health," said Special Agent-in-Charge Kim Rice of FDA's Office of Criminal Investigations. "The FDA will continue to devote resources to criminal investigations targeting pharmaceutical companies that disregard the safeguards of the drug approval process and recklessly promote drugs for uses for which they have not been proven to be safe and effective."

"The illegal scheme used by Eli Lilly significantly impacted the integrity of TRICARE, the Department of Defense's healthcare system," said Ed Bradley, Special Agent-in-Charge, Defense Criminal Investigative Service. "This illegal activity increases patients’ costs, threatens their safety and negatively affects the delivery of healthcare services to the over nine million military members, retirees and their families who rely on this system. Today’s charges and settlement demonstrate the ongoing commitment of the Defense Criminal Investigative Service and its partners in law enforcement to investigate and prosecute those that abuse the government's healthcare programs at the expense of the taxpayers and patients."

"This case should serve as still another warning to all those who break the law in order to improve their profits," said Patrick Doyle, Special Agent-in-Charge of the Office of Inspector General for the Department of Health and Human Services in Philadelphia. "OIG, working with our law enforcement partners, will pursue and bring to justice those who would steal from vulnerable beneficiaries and the taxpayers."

The civil settlement resolves four qui tam actions filed in the Eastern District of Pennsylvania: United States ex rel. Rudolf, et al., v. Eli Lilly and Company, Civil Action No. 03-943 (E.D. Pa.); United States ex rel. Faltaous v. Eli Lilly and Company, Civil Action No. 06-2909 (E.D. Pa.); United States ex rel. Woodward v. Dr. George B. Jerusalem, et al., Civil Action No. 06-5526 (E.D. Pa.); and United States ex rel. Vicente v. Eli Lilly and Company, Civil Action No. 07-1791 (E.D. Pa.). All of those cases were filed by former Eli Lilly sales representatives.

The criminal case is being prosecuted by the U.S. Attorney’s Office for the Eastern District of Pennsylvania and the Office of Consumer Litigation of the Justice Department’s Civil Division. The civil settlement was reached by the U.S. Attorney’s Office and the Commercial Litigation Branch of the Justice Department’s Civil Division.

This matter was investigated by the FDA’s Office of Criminal Investigations, the Defense Criminal Investigative Service and the Department of Health and Human Services Office of Inspector General.

Assistance was provided by representatives of FDA’s Office of Chief Counsel and the National Association of Medicaid Fraud Control Units.

The Corporate Integrity Agreement was negotiated by the Office of Inspector General of the Department of Health and Human Services.

Eli Lilly's guilty plea and sentence is not final until accepted by the U.S. District Court.

New CIA; New DoJ/SEC Investigations — As Of August 2, 2010

This new corporate integrity agreement (mentioned on page 26 of the just-filed SEC Form 10-Q) is plainly material, and will have to be disclosed as an exhibit to the Form 10-Q, for the third quarter of 2010.

This new corporate integrity agreement (mentioned on page 26 of the just-filed SEC Form 10-Q) is plainly material, and will have to be disclosed as an exhibit to the Form 10-Q, for the third quarter of 2010.Do look for it then; I know I will:

. . . .Effective August 2, 2010, Merck and HHS-OIG executed a Unified CIA, which replaced the individual CIAs that had been signed by Old Merck and Schering-Plough prior to the Merger. The Unified CIA incorporates certain of the requirements of the individual CIAs of Old Merck and Schering-Plough and is similar, although not identical, to those legacy CIAs. Merck assumes the compliance obligations of the Unified CIA through February 5, 2013, which is the same as the Old Merck CIA. The Company believes that its promotional practices and Medicaid price reports meet the requirements of the Unified CIA.The Company has received letters from the DoJ and the SEC that seek information about activities in a number of countries and reference the Foreign Corrupt Practices Act. The Company is cooperating with the agencies in their requests and believes that this inquiry is part of a broader review of pharmaceutical industry practices in foreign countries. . . .

Adverse outcomes here would be material to Merck.

Subscribe to:

Posts (Atom)